Tech

Huawei has demonstrated to the world that making electric cars is as easy as assembling smartphones

Following the resounding success of the Aito M7 electric car, Huawei is poised to launch two new car models and outsource the labeling and production to at least five companies. This strategy has sparked considerable controversy among traditional electric vehicle manufacturers in China.

According to Bloomberg, following the resounding success of the Aito M7 SUV electric car, Huawei is now planning to launch two more new car models to demonstrate China’s strength in the electric vehicle sector to the world.

Although Huawei faces challenges in the smartphone market due to restricted semiconductor supply from the United States and Western countries, it is precisely because of these challenges that the Chinese conglomerate has diversified its product portfolio and made significant breakthroughs in the electric vehicle industry.

For instance, Huawei’s Aito M7 series is priced at only 250,000 Chinese yuan, equivalent to $34,300, which is much cheaper than other models of the same category from Tesla. This product is a result of Huawei’s collaboration with Seres Group and has received 80,000 orders within just the first 50 days of its launch.

The success of Huawei demonstrates that despite pressure in the smartphone and 5G sectors, Chinese businesses can still find a way to thrive with the support of the government and the technological infrastructure built over many years.

Furthermore, Huawei’s ability to secure numerous orders for its electric car model also showcases China’s advantage in current automotive manufacturing capabilities.

Instead of investing heavily in developing electric vehicles like many other young startups, Huawei has chosen to outsource most of the hardware components and focus on its core strength: software.

After developing the control systems and driver assistance features, Huawei simply applies its brand label and sells the products. Meanwhile, the manufacturing responsibilities are handled by the startups, which benefit from the orders and do not have to worry about market penetration since they are associated with a renowned name like Huawei.

Is making electric cars easy?

According to Bloomberg, Huawei is collaborating and outsourcing with at least five other automobile manufacturers to develop electric cars under its brand label. The company is soon set to launch two new electric car models, the Avatr 12, produced by Chongqing Changan Automobile, and the Luxeed S7, produced by Chery Automobile.

By outsourcing the entire production process, Huawei focuses solely on developing control software and driver assistance features, such as customization on highways or voice interaction capabilities.

The practice of outsourcing and branding is also favored by many startups, as they can increase sales thanks to the reputation of Huawei. With its vast distribution channels, Huawei sells the Aito electric car directly in its mobile phone retail stores.

It should be noted that Huawei is currently leveraging the national spirit of the Chinese people to stimulate sales.

According to Bloomberg, many customers purchased the newly released 5G product, the Mate 60, as an act of national pride and patriotism, rather than solely for practical use. This is the first return of Huawei to the smartphone market since facing Western sanctions on chips.

This pattern may also repeat itself in Huawei’s electric vehicle sector.

“The success of the Aito-Huawei electric car is 50% due to the national spirit and the other half is due to technological quality,” said Daniel Kollar, Director of the consulting firm Intralink.

Currently, experts are closely monitoring Huawei’s moves to determine the long-term viability of this electric vehicle business model, considering the presence of over 100 competitors in the market and hundreds of electric car models available for customers to choose from.

According to the disclosed information, the Avatr 12 model will be priced at 300,800 Chinese yuan and equipped with Huawei’s intelligent control software ADS 2.0, featuring 29 sensors and 11 high-capacity cameras.

The collaboration between Chongqing Changan and Huawei in the Avatr series represents a new breakthrough in the electric vehicle industry. Chongqing has only sold 12,000 units of the previous Avatr model in the 12 months leading up to September 2023. Therefore, the collaboration with Huawei for the Avatr 12 is expected to boost sales and bring benefits to both parties.

All for survival

According to Bloomberg, the outsourcing and branding strategy of Huawei’s electric cars is considered a smart solution in the context of a saturated Chinese market.

Self-production of electric cars has become unprofitable due to weak consumer demand, which is not enough to offset the costs amid Tesla’s ongoing price war.

Meanwhile, many electric car startups such as WM Motor and China Evergrande’s NEV have either filed for restructuring or halted trading due to their inability to repay debts.

Other young electric car companies have had to engage in buyouts and mergers with each other in order to survive in the competitive market.

Volkswagen and Audi have signed contracts with startups Xpeng and IM Motor to develop electric cars. Stellantis has invested $1.1 billion to acquire a 21% stake in Zhejiang Leapmotor Technology, an electric car startup based in Hangzhou.

“Huawei’s strategy is to leverage its technological strength by collaborating with as many different companies as possible, so that when market consolidation happens, they will have a network of partnerships with surviving companies in the electric car industry,” said Daniel Kollar, Director at Intralink.

Furthermore, Bloomberg reports that Huawei’s move comes at a time when many companies have applied to manufacture electric cars but face delays due to tighter government regulations in Beijing, which aims to prevent a market bubble from forming.

By outsourcing or collaborating with various companies to produce electric cars, Huawei has surpassed Xiaomi in this field. Xiaomi is still waiting for government approval to manufacture its own electric cars, but the current market conditions pose significant challenges.

Even Didi Global, a well-known ride-hailing platform in China, intended to enter the electric car market by partnering with Xpeng. However, due to the difficulties in obtaining licenses, Didi decided to abandon the project.

Returning to Huawei, the success of the Aito product has made many other electric car companies envious.

He Xiaopeng, the founder of Xpeng, a struggling electric car startup facing significant losses and struggling to increase sales, raised doubts about the safety of Aito’s automated emergency braking system and its suitability for nationwide deployment.

On the other hand, Chen Hong, Chairman of SAIC Motor, one of the largest electric car companies in China, believes that cooperating with Huawei and using the telecommunications company’s software is akin to handing over control and the essence of the product to external parties.

Huawei responded by stating that they do not aim to control anyone but rather hope to assist the struggling electric car industry.

“In the era of increasingly popular smart electric vehicles, competition in this field will become extremely fierce. Therefore, in the long run, I believe that companies closely cooperating with Huawei can survive and become one of the few remaining companies,” said Richard Yu, Director in charge of Huawei’s electric car division, frankly.

Source: Bloomberg

Read more: Get a Tesla: If you want to know how AI is “harmful to humans”, According Co-founder of Apple

Tech

Behind the handshake between Google and Apple: the calculations to crush the competition.

Google and Apple have reached an agreement on the default search engine, but that is just the tip of the iceberg.

Google is the world’s most popular search engine and the default choice on most popular platforms, but that doesn’t mean it doesn’t have competitors, and the most potential and concerning competitor is Apple.

For many years, Google has closely monitored Apple’s advancements in their search technology, wondering if this important long-term partner would eventually build its own search engine and apply it as the default on every iPhone and Mac worldwide.

Those concerns escalated in 2021 when Google paid Apple around $18 billion to keep Google search as the default choice on iPhones. In the same year, Apple’s search tool on the iPhone, Spotlight, started displaying richer web results for users, similar to the results they could find on Google.

The calculations behind the Google and Apple collaboration

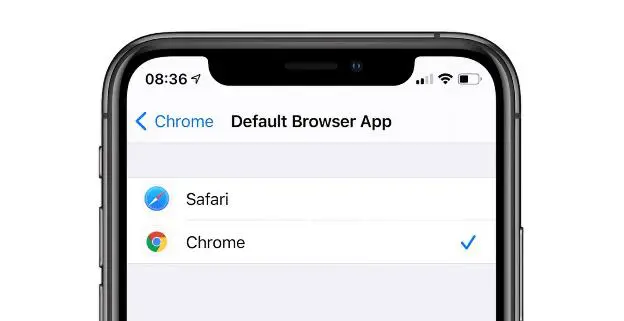

Google has quietly devised plans to thwart Apple’s foray into the search market. The company has been trying various strategies to attract Spotlight users, such as releasing a similar version for iPhones and persuading many iPhone users to use Google’s Chrome web browser instead of Apple’s Safari browser. Additionally, Google has explored ways to circumvent Apple’s control over iPhones by leveraging new European laws designed to help smaller companies compete with Big Tech.

Google’s anti-Apple strategy highlights the importance the company’s executives place on maintaining dominance in the search business. We also observe the complex relationship between Google and Apple, as competitors in the consumer devices and software space, while also being important partners in Google’s mobile advertising business for over a decade.

This relationship has been carefully examined in a landmark antitrust lawsuit brought against Google by the U.S. Department of Justice and several states. Government lawyers argued that Google manipulated the market to its advantage through default agreements signed with companies including Apple, Samsung, and Mozilla. These agreements directed traffic to Google’s search engine when users conducted searches through their browsers.

Google will participate in the ongoing months-long defense process of the lawsuit, which took place last weekend. To date, the company has downplayed the role of default agreements with phone manufacturers and browsers in their success. Google argues that their search engine is popular due to its quality and continuous innovation, and users can easily choose an alternative default in their device settings.

However, documents reviewed by The New York Times indicate that Google understands the power of default positioning in directing users towards a product, as they strive to become the default choice on Safari.

“Competition in the tech industry is fierce, and we compete with Apple on multiple fronts,” said Peter Schottenfels, a spokesperson for Google. “There are more ways than ever to search for information today, which is why our engineers make thousands of improvements each year to Search to ensure we deliver the most helpful results.”

He added that while Google does pay for default settings because they matter, users have the ability and ease to change their default settings.

Google’s desire to “take on” Apple

In the fall of last year, Google’s executives held a meeting to discuss ways to reduce reliance on Apple’s Safari browser and how to best leverage the new European laws to weaken the iPhone manufacturer. While Google considered various options, including the amount of data they could access on iPhones, it remains unclear what decisions the executives made.

At that time, the European Union was preparing the Digital Markets Act, designed to help smaller companies break the tech giants’ control over the industry. Google, being one of the world’s largest internet companies, was also a target of this legislation, but the behemoth saw an opportunity.

According to the law, the European Union is compelling large tech companies to open up their platforms to competition starting in March, allowing users to choose which services they want to use and ending the prioritization of their own services on their platforms.

This law is expected to force Apple to allow customers in the European Union to download rival app stores. Users setting up new Apple devices in Europe may also be offered the option to choose a different default browser other than Safari.

Google, a company that will be legally compelled to allow more competition in the search field, has sought ways to maneuver through European regulatory agencies to break Apple’s tightly controlled software ecosystem, in order to attract users from Safari and Spotlight, according to documents obtained by The New York Times.

Google’s executives calculated that if users had the choice, the number of iPhone users in Europe opting for Chrome could triple. That would mean the company could retain more search advertising revenue and pay less to Apple.

Gus Hurwitz, a senior fellow at the University of Pennsylvania Carey Law School, noted that regulations aimed at helping smaller companies enter the market “often end up being used by larger incumbents to gain an advantage over their rivals.”

Google and Apple have had a search partnership for Safari since 2002, a decade before the launch of the iPhone. The relationship became more complex when Google released the Android mobile operating system in 2008, directly competing with the iPhone.

Google had concerns about Apple’s Spotlight tool from its early days. In 2014, an internal presentation discussed the potential impact of Apple’s new operating system, iOS 8, on Google’s revenue. The second page of the slide was titled “Summary: It’s bad,” according to evidence presented in the antitrust trial.

Apple recruited Google’s former head of search, John Giannandrea, in 2018 and expanded its search team to build a more effective Spotlight system. According to someone familiar with the discussions, the improvements to the tool in 2021, as part of iOS 15, raised concerns at Google about Apple’s intentions in the search market.

In response, Google has made efforts to build its own version of Spotlight to operate on iPhones, according to documents. Google’s version provides users with quick information from files, messages, and apps on the device.

In recent years, Apple has not used Spotlight to collect what is known as commercial queries – queries with advertisements in the results – from Google, so the tool has not harmed Google’s search business operations.

However, Google’s executives last year considered ways to convince the European Union to classify Spotlight as a search tool. Spotlight includes at least five different search features, offering web image search, rich answers and results, and global search that can scan information across devices, apps, and the web.

Google’s exploitation of the law to assist smaller companies has disappointed some legal experts.

Gus Hurwitz said, “I like companies competing by providing higher-quality products, not by paying lawyers to go to the European Union and enact regulations to get access to their competitor’s platform.”

Computer

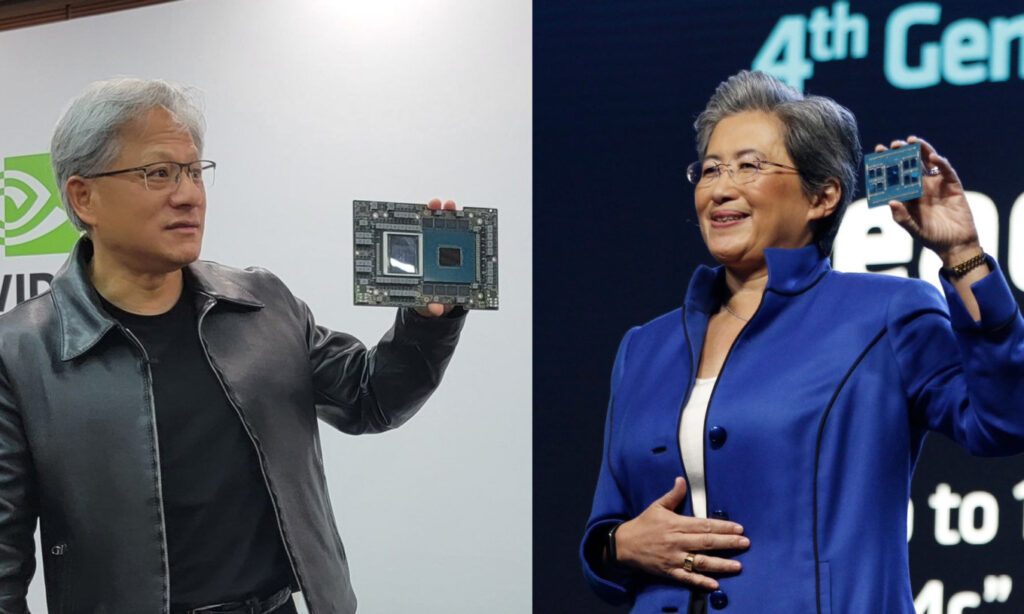

CEO Nvidia and AMD: Two nephews disrupting the AI chip industry.

Nvidia CEO and AMD CEO: Two influential figures in the AI chip industry and also relatives from Taiwan.

The close relationship between Nvidia CEO Jensen Huang and AMD CEO Lisa Su was first mentioned by Ms. Su in 2020 during an event by the Consumer Technology Association (CTA). “We are distant relatives,” she revealed.

Recently, genealogist Jean Wu from Taiwan also revealed details about the two individuals based on a series of administrative documents showing that Jensen Huang is a cousin of Lisa Su. Both leaders have not commented on the information, but a spokesperson from Nvidia confirmed that Mr. Huang is a distant relative of Ms. Su.

A Similar Path

The familial relationship between Jensen Huang and Lisa Su has attracted attention from industry analysts in the semiconductor field.

“I was truly surprised,” said Wu about her discovery.

Christopher Miller, author of the book Chip War: The Fight for the World’s Most Critical Technology, also expressed surprise at the revelation that the leaders of Nvidia and AMD are relatives. “The fact that these two individuals with shared family roots in Taiwan are at the forefront of the semiconductor industry is remarkable,” he said.

According to Edith Yeung, a partner at the venture capital firm Race Capital in Silicon Valley, Taiwan is developing world-class computer hardware to drive its economy. Companies such as TSMC, Asus, Acer, and Foxconn are leading the industry, encouraging many young people to pursue careers as technology engineers.

“For nearly 50 years, the economy in Taiwan has revolved around the production of electronic devices, as well as chip design, manufacturing, and assembly. Semiconductors are the largest export sector here, attracting many young individuals to pursue careers in this field,” Miller explained. Jensen Huang and Lisa Su are no exception, although they mostly grew up abroad.

Huang was born in 1963 in Taipei before moving to Tainan. His family relocated to Thailand when his father worked at an oil refinery. When Huang was 9 years old, political unrest in Thailand led his parents to send him and his brother to live with relatives in Washington state, United States. He later attended boarding school in Kentucky.

Lisa Su was born in Tainan in 1969. Her family immigrated to the United States three years later and settled in New York.

Despite growing up in different places, Jensen Huang and Lisa Su share a common career path. They both pursued electrical engineering, with Su attending the Massachusetts Institute of Technology (MIT) and Huang studying at the University of Oregon and Stanford University.

They entered the semiconductor industry and both had stints at AMD. Huang worked as a microprocessor designer at the company before founding Nvidia in 1993. Su joined AMD nearly 20 years later and held high-level executive positions, earning praise for revitalizing the company.

From relatives to rivals

Now, both are high-level technology leaders. Their offices are located in Santa Clara, California, just a 5-minute drive apart.

Nvidia and AMD both sell hardware and software to leading technology companies, participating in an industry that could reach $1 trillion by 2030. In their latest annual report, AMD considers Nvidia as a top competitor in two out of four major business areas, which are data centers and gaming devices.

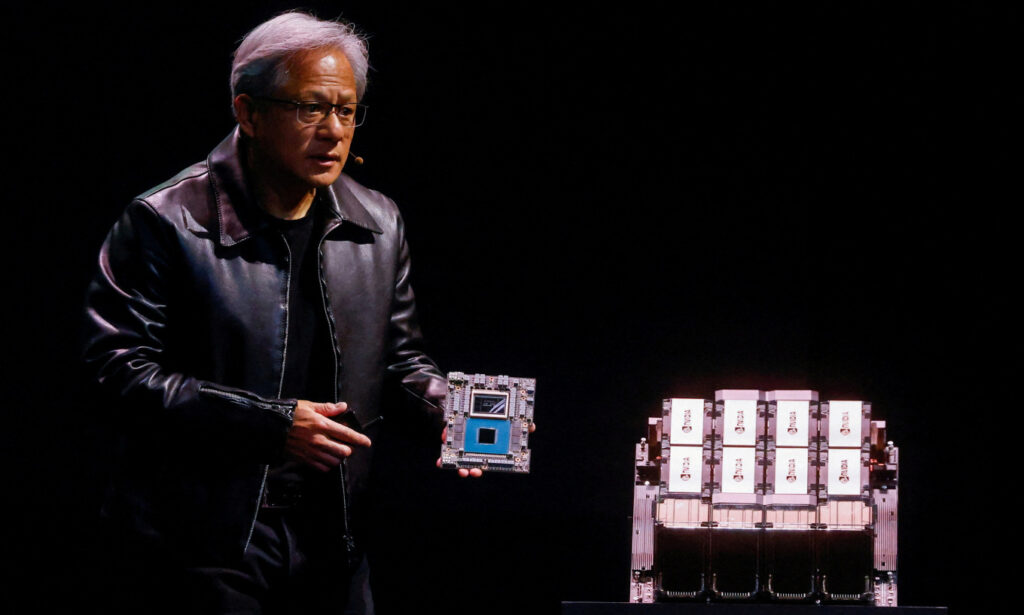

Nvidia and AMD are both renowned for their graphics processing units (GPUs) specialized in image processing for gaming. GPUs now also play a significant role in the AI race, a technology closely associated with popular products like ChatGPT.

Nvidia’s H100 chip is used by OpenAI to train the language model for ChatGPT, while AMD has also released the MI300X series, which they call “the world’s most advanced AI inference processor.” On October 31st, AMD stated that their GPUs could generate revenue of over $2 billion in 2024, emphasizing that the MI300 is projected to be the “fastest $1 billion revenue-generating product in the company’s history.”

Both companies also compete in the data center product market, including CPUs and data processing units (DPUs).

In recent years, Nvidia and AMD have been recognized for bringing cutting-edge technologies that have the potential to reshape society. Their processors are increasingly prevalent in electric vehicles and AI systems, in addition to traditional markets like personal computers and gaming consoles.

“Anyone who connects to the internet may need dozens or even hundreds of Nvidia and AMD chips. Most users don’t pay attention because they never see the chips produced by these two companies. However, the daily lives of many people rely on chips from both companies,” said Miller.

The AI boom has significantly boosted Nvidia’s value, with the company’s stock rising by 208% this year. AMD’s stock has also increased by 73%, despite the company being much smaller in scale compared to Nvidia.

Lisa Su is currently one of the highest-paid executives in the United States and topped the list of highest-paid female CEOs in the S&P 500 index last year. She has praised Nvidia as a “great company” when asked about her family relationship with Huang.

“They both possess leading technologies in key AI areas over the past 10 years. It is a competitive world, and there is no doubt that we compete fiercely, but it is also a world where we have to collaborate with our counterparts,” said the CEO of AMD.

AI

Elon Musk’s super AI Grok was created within two months.

The development team of xAI stated that Grok was trained for two months using data from the X platform.

“Grok is still in the early testing phase, and it is the best product we could produce after two months of training,” xAI wrote in the Grok launch announcement on November 5th.

This is one of the AI systems that has been trained in the shortest amount of time. Previously, OpenAI took several years to build large language models (LLMs) before unveiling ChatGPT in November 2022.

xAI also mentioned that Grok utilizes a large language model called Grok-1, which was developed based on the Grok-0 prototype with 33 billion parameters. Grok-0 was built shortly after the company was founded by Elon Musk in July of this year.

With a total time of approximately four months, the company asserts that Grok-1 surpasses popular models like GPT-3.5, which is used for ChatGPT. In scoring benchmarks on mathematical and theoretical standards such as GSM8k, MMLU, and HumanEval, xAI’s model outperforms LLaMa 2 70B, Inflection-1, and GPT-3.5.

For example, in a math problem-solving test based on this year’s Hungarian National High School Math Competition, Grok-1 achieved a score of 59%, higher than GPT-3.5’s score of 41% and only slightly below GPT-4 (68%).

According to xAI, the distinguishing feature of Grok is its “real-time world knowledge” through the X platform. It also claims to answer challenging questions that most other AI systems would reject.

On the launch day, Musk also demonstrated this by asking the question, “the steps to make cocaine.” The chatbot immediately listed the process, although it later clarified that it was just joking.

This is the first product of Musk’s xAI startup, which brings together employees from DeepMind, OpenAI, Google Research, Microsoft Research, Tesla, and researchers from the University of Toronto. Musk is also a co-founder of OpenAI, the organization behind ChatGPT, established in 2015. He later left the company due to disagreements over control. During his departure, he declared his intention to compete for talent from the company while also cutting off the previously promised $1 billion in funding.

Read more: Google, Meta, Microsoft, OpenAI… agree with voluntary measures to protect AI.

-

AI1 year ago

AI1 year agoAI only needs to listen to the sound of keystrokes to predict the content, achieving an accuracy rate of up to 95%

-

AI2 years ago

AI2 years agoMusk aims to create a super AI to rival ChatGPT

-

Mobile2 years ago

Mobile2 years agoProduction issue with iPhone 15 display raises concerns among users

-

Entertainment2 years ago

Entertainment2 years agoSurprisingly, a single YouTube video has the potential to cause serious harm to Google Pixel’s top-of-the-line smartphone

-

AI2 years ago

AI2 years agoUpon its debut, Google’s chatbot Bard dealt a cold blow to its very creator.

-

Entertainment2 years ago

Entertainment2 years agoCS:GO Breaks Records with Surging Gamer Engagement and Increased Spending

-

Crypto1 year ago

Crypto1 year agoExplore in detail about Web 3

-

Tips & Tricks2 years ago

Tips & Tricks2 years agoHow to distinguish AI-generated photos?