Crypto

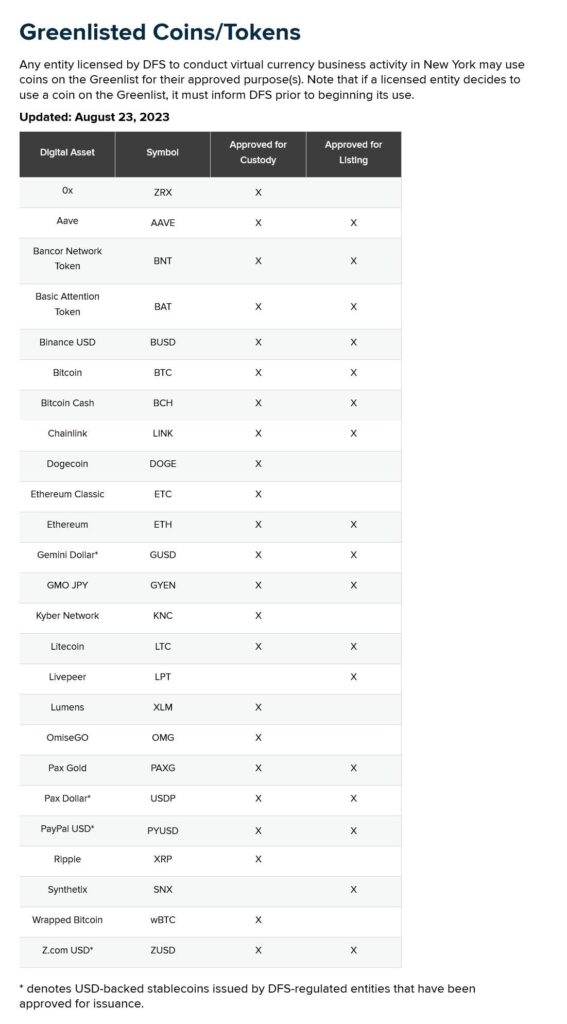

New York is demanding crypto companies to enhance their coin listing standards.

The financial regulatory agency of New York wants licensed crypto companies to be more transparent about the coin listing and delisting processes of cryptocurrencies.

According to The Wall Street Journal, the New York Department of Financial Services (NYDFS) has introduced a new legal framework that requires cryptocurrency companies to draft a policy for establishing “coin listing and delisting regulations” in order to enhance the criteria for evaluating a coin on an exchange.

Regarding the “Coin Listing Policy,” NYDFS requires cryptocurrency companies to base their drafting on three factors, including:

1. Governance of the listing process.

2. Risk assessment procedures for the coin.

3. Coin monitoring procedures.

Furthermore, the “Listing Policy” must be continuously adjusted to align with the company’s business model, customer operations, and other relevant factors.

Regarding the “Coin Delisting Policy,” the financial regulatory agency of New York requires companies to provide detailed explanations for their decisions, including:

– Reasons for the delisting.

– Events that led to the delisting.

– Estimated timeline for the delisting, including advance notice to customers and a prepared plan to analyze the impact.

Once approved, companies may independently assess a coin’s compliance with the standards without seeking permission from NYDFS. However, companies still need to continuously update NYDFS in writing with a comprehensive portfolio of coins they are offering or utilizing.

Director Adrienne Harris of NYDFS asserts:

“This guidance is necessary to enhance standards prior to coin offerings, and any deficiencies identified through examinations will also be updated accordingly.

When we discover a coin that investors believe is sound, or when we identify risks and misuses of that coin, we want companies to have a delisting solution in place to protect users in a safe and sound manner.”

The new legal frameworks were introduced as Director Harris celebrated her two-year tenure at the helm of New York’s largest financial regulatory agency. NYDFS has consistently sought to make New York a leader in regulating insurance, banking, and finance to establish a comprehensive governance program for cryptocurrencies nationwide.

Under Director Harris’s leadership over the past two years, the agency has taken several legal actions against cryptocurrency companies, including imposing a $50 million fine on Coinbase exchange for lax KYC practices and levying a $30 million penalty on online cryptocurrency trading platform Robinhood for various allegations, including failure to comply with the Bank Secrecy Act and Anti-Money Laundering rules.

The agency also played a role in overseeing the closure process of Signature Bank and transferring management and full deposit returns to the Federal Deposit Insurance Corporation (FDIC) for customer protection.

During the collapse in March 2023, Signature Bank held assets of $118 billion and became the third-largest bank failure in U.S. history, preceded by Silicon Valley Bank and Silvergate Bank, which occurred in the same month.

This is the next development by NYDFS in April 2023, as they planned to issue new regulations on how cryptocurrency companies will be evaluated. According to the announcement at the time, the legal framework requires companies to meet strict standards regarding capital, cybersecurity, and anti-money laundering measures.

Since the beginning of 2023, the United States has consistently taken legal actions in supervising the cryptocurrency industry, including:

- In April 2023, the U.S. House of Representatives introduced a draft bill for new stablecoin legislation, which proposed banning stablecoins backed by other cryptocurrencies and directing research on central bank digital currencies (CBDC).

- On August 14th, 2023, the Federal Deposit Insurance Corporation (FDIC) issued several supervisory measures and guidelines to address the risks associated with cryptocurrency assets.

Crypto

What is MetaFi? Will MetaFi explode in the future?

1. What is MetaFi ?

MetaFi is a term that refers to the combination of Metadata and DeFi (Decentralized Finance) to enhance the interoperability of the BNB Chain, as mentioned in 2022. MetaFi represents a new model aimed at standardizing blockchain technology for traditional Web2 businesses in areas such as gaming, social media, and the metaverse.

MetaFi is a concept that provides advanced DeFi infrastructure by utilizing Metadata to determine content ownership for projects related to the metaverse, GameFi, SocialFi, Web3, and NFTs. Additionally, MetaFi can involve the combination of fungible tokens and non-fungible tokens (NFTs) along with a community governance system such as DAO (Decentralized Autonomous Organization).

The goal of MetaFi is to build and promote a new ecosystem based on the standardization of metadata while applying it to Web3 and blockchain technology. Furthermore, MetaFi is being developed with the aim of achieving mass adoption, offering users a wide range of use cases with cryptocurrencies and NFTs.

2. The operating mechanism of MetaFi

Leveraging metadata from the blockchain

One of the main foundations of MetaFi is the utilization of metadata from the blockchain. Most popular blockchains like Bitcoin and Ethereum store valuable information about different types of assets within the network.

For example, when users own an NFT, the associated metadata includes detailed information about the digital artwork, the creator, and the ownership history that is often linked to that NFT.

Additionally, Bitcoin users can also carry metadata, including unencrypted data. This feature has opened up new possibilities to enhance the functionality of the blockchain beyond simple asset transfers.

Interoperability and Standardization Capability

MetaFi is developed based on the idea of interoperability between different blockchains. To achieve this, MetaFi establishes general metadata standards that can be implemented across multiple blockchains. Imagine if all blockchains could display their metadata in a structured and uniform way. MetaFi would enable high compatibility among different blockchain ecosystems.

For example, an NFT marketplace operating within the MetaFi framework has the ability to seamlessly analyze and categorize NFTs from various blockchains. This means that users can view, interact with, and transact with NFTs from Ethereum, BNB Chain, and other blockchains within the same virtual environment, thanks to standardized metadata.

Machine-Readable and Organizable Assets

By adhering to these metadata standards, MetaFi ensures that assets such as coins/tokens and NFTs are machine-readable and organizable. This opens up exciting possibilities for automation and data-driven decision-making within the metaverse.

For example, a MetaFi-supported metaverse can automatically assess the risks and values of a diversified portfolio of assets spread across different blockchains. Additionally, information about different types of assets can be presented in a visually intuitive manner within the metaverse.

3. The necessary technologies for developing MetaFi

Blockchain Layer 1: Ethereum is a suitable choice for developing MetaFi to provide powerful smart contract capabilities and a large community. Additionally, BNB Chain is also an attractive option for MetaFi projects due to lower transaction fees and faster transaction confirmation.

Programming Language: Solidity is the most optimized programming language for creating smart contracts on Ethereum and other EVM-compatible blockchains.

Decentralized Identity (DID): DID standards are crucial for managing user identities and ensuring access rights to digital assets within MetaFi.

Oracle: Chainlink provides oracles that allow MetaFi applications to access and standardize real-world data.

Blockchain Layer 2: Layer 2 blockchains such as rollups and sidechains help improve scalability and reduce transaction costs to enhance user experience.

Interoperability Protocols: Polkadot’s interoperability capabilities enable MetaFi projects to connect with different blockchains and expand their reach. Additionally, Cosmos provides similar interoperability capabilities and promotes cross-chain communication.

JavaScript Development: Web3.js is a JavaScript library that facilitates interaction with Ethereum and EVM-compatible blockchains. Additionally, Ether.js is an alternative developer-friendly solution to Web3.js as it simplifies interactions with smart contracts.

Front-End Development: React is a popular front-end library for building user interfaces in MetaFi applications. Additionally, Vue.js is another choice for creating user interface experiences.

Back-End Development: Node.js is a suitable choice for building server-side applications and handling API requests. Additionally, Express.js is another option that simplifies back-end development.

Database Solutions: MongoDB is a commonly used NoSQL database for storing and managing user data. Additionally, PostgreSQL is a choice for structured data storage in MetaFi applications.

Security Tools: MythX is a security tool that identifies vulnerabilities in smart contracts. Additionally, OpenZeppelin is a library of tested smart contract patterns and tools for developers concerned with security.

Testing and Debugging Tools: Truffle is a tool that simplifies testing and deploying smart contracts. Additionally, Hardhat is a flexible development tool for Ethereum projects equipped with testing and debugging features.

4. Applications of MetaFi

Metaverse

The metaverse is a digital space where users can engage in various activities ranging from social interactions to transactions and gaming. However, the challenge lies in ensuring interoperability between these virtual worlds, similar to the initial difficulties faced by fragmented liquidity in decentralized exchanges (DEXs).

MetaFi can serve as a bridge to connect different metaverse ecosystems and enable seamless transfer of assets, social interactions, and rich experiences. Some notable metaverse projects include Decentraland, The Sandbox, My Neighbor Alice,…

GameFi

GameFi will greatly benefit from the interactive capabilities of MetaFi, allowing players to collect virtual assets, weapons, or currency in various games. Additionally, MetaFi enables players to seamlessly buy, sell, and trade their virtual assets across games or even marketplaces, creating a vibrant virtual economy.

Some notable GameFi titles include Axie Infinity, Sorare, Gods Unchained,…

Marketplace

A Marketplace supported by MetaFi that aggregates and lists various types of assets across multiple blockchains can be imagined. This would provide collectors and investors with a unified interface and simplify the exchange of NFTs and other digital assets.

The convenience and efficiency of such a Marketplace can open up new aspects in trading and asset ownership, avoiding the limitations of individual chains. Currently, some prominent NFT Marketplaces that allow users to trade NFTs across multiple blockchains are OpenSea, Blur, Rarible,…

Cross-chain

One of the most promising applications of MetaFi is its potential to bridge the liquidity gap between different DeFi platforms across multiple blockchains. Currently, the DeFi ecosystem operates independently, leading to fragmented liquidity and restricted trading. Therefore, MetaFi can create a standardized cross-chain bridge for various assets, enabling seamless trading of coins/tokens and NFTs across multiple blockchains.

Furthermore, this interoperability capability will enhance liquidity and reduce transaction costs for users. Some notable cross-chain bridges include Stargate Finance, Orbiter Finance, Bungee Exchange,…

Yield Farming NFT

wallets, users can leverage them to earn profits through staking or using them as collateral for borrowing coins/tokens. The functionality of NFTs can vary depending on the issuer. Some NFTs can be rented out for use in games or provide access to exclusive databases, thereby generating diverse income streams for asset owners.

Some notable Yield Farming NFT platforms include NFTX, NFTfi, BendDAO,…

Decentralized Identity – DID

In the future with the support of MetaFi, blockchain-based identity verification can be standardized in a decentralized manner globally. As a result, users can securely manage their digital identities and easily verify them across multiple platforms and services. This has the potential to revolutionize online identity verification and reduce the need for performing KYC processes, thereby enhancing user privacy.

Whether accessing financial services or participating in the metaverse, individuals can rely on their MetaFi-linked digital identities for seamless interactions. Some identity projects that can be mentioned include Worldcoin, zkPass, Port3 Network,…

DAO

DAOs are organizations managed by smart contracts and token holders, and they can leverage MetaFi to enhance their governance processes. Standardized metadata and interoperable assets can facilitate easy management and voting on proposals related to various types of assets within DAOs. This can rationalize decision-making within these decentralized entities, making them more efficient and responsive to community members.

Fan token

Fan tokens are often associated with sports teams, celebrities, or brands that can greatly benefit from the standardization provided by MetaFi. Fan tokens can optimize the minting and trading processes of tokens by providing a consistent framework for transaction information.

Currently, the complexity and cost of setting up and trading fan tokens vary significantly across different blockchains, indirectly hindering widespread adoption. Some popular fan tokens include Chiliz (CHZ) – a blockchain that creates fan tokens, FC Barcelona Fan Token, Paris Saint-Germain Fan Token,…

5. MetaFi faces several challenges:

1. High technological requirements: MetaFi represents a comprehensive ecosystem based on metadata existing in the virtual world and comes with a set of requirements for both software and hardware. These requirements pose challenges not only for developers building MetaFi but also for users who want to interact with it.

2. Interoperability between blockchains: MetaFi encounters challenges arising from operating across different blockchains. The ability for DApps to interact within MetaFi requires accessing and transacting information across multiple platforms and blockchain networks. Each blockchain has its own ecosystem and cannot directly “communicate” with each other. This creates issues such as high transaction fees and low scalability. Therefore, research and improvements in Layer 1 blockchain technology are needed to make accessing DApps on each blockchain easier.

3. Sustainable tokenomics model: MetaFi requires a truly sustainable tokenomics model that provides users with stable benefits and long-term growth potential. A good tokenomics model will prevent major sell-offs due to significant decreases in APY from staking, farming, or airdrop rewards.

4. The concern regarding the governance model is an important issue in MetaFi. According to BNB Chain, the ideal governance model for MetaFi is to empower token holders with useful features such as voting rights and profit-sharing. This needs to be clear and transparent to protect all participants.

6. Future of MetaFi

identity management, giving users full control over their identities.

For example, Name Services like Ethereum Name Service (ENS), BNB Name Service (BNS), provide tools to address the issue of lengthy and complex wallet addresses. They allow you to send your tokens to a simpler wallet address like “vitalik.eth” instead of having to enter a long ERC-20 address.

To truly become a connected ecosystem, MetaFi requires high interoperability between blockchains. This can be achieved through multichain bridges that facilitate seamless data transmission and large-scale asset transfers.

MetaFi is a term that combines Metadata and DeFi, aiming to improve the interaction capabilities as mentioned by BNB Chain in 2022. MetaFi aims for mass adoption to provide users with various use cases involving cryptocurrencies and NFTs. However, it may take a considerable amount of time for widespread user adoption of MetaFi to occur.

Crypto

MetaMask – Tips and tricks when using the MetaMask wallet.

1. Adjust transaction fees

For every transaction you perform in MetaMask, you will need to pay a gas fee. You can easily customize the amount of gas you pay for each transaction. For example, sometimes you may want to pay more to expedite your transaction, while at other times, you may be willing to wait longer for a cheaper fee.

Whether your transaction succeeds or not, you still have to pay the fee because even if the transaction fails, validators still have to verify and process it, which also incurs a cost similar to a successful transaction.

Typically, users have to endure high transaction fees on Ethereum, so here are some ways to help you control transaction fees on this chain.

1.1. Adjusting Gas Limit on MetaMask

You can customize the gas fee for your transactions in the following ways:

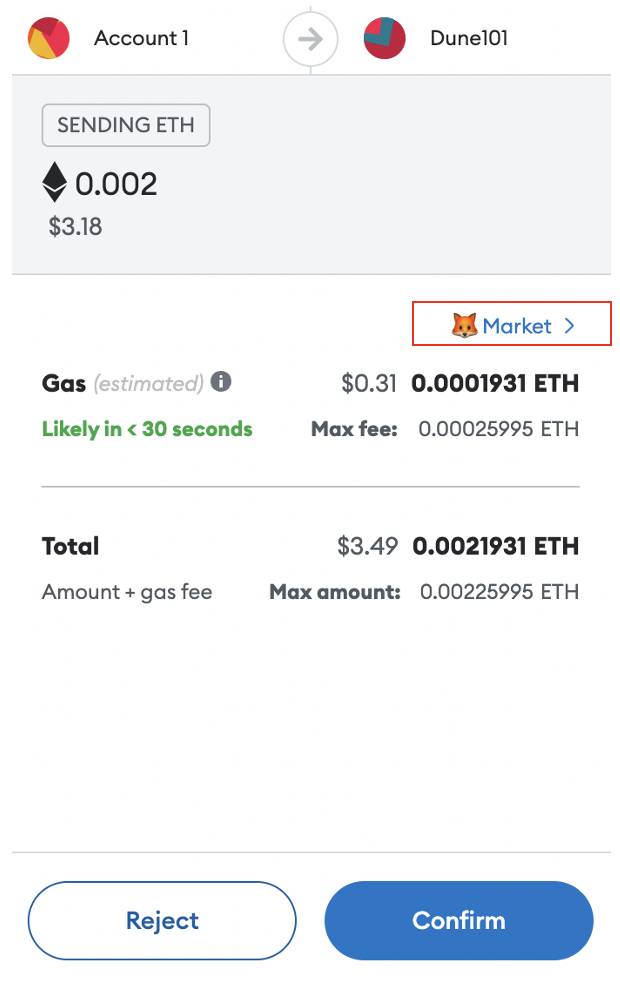

When you start sending a transaction, after entering the amount of tokens you want to send, you will be redirected to the confirmation step displaying the total amount, including the gas fee. At this point, you can click on the “Market” icon to change the gas.

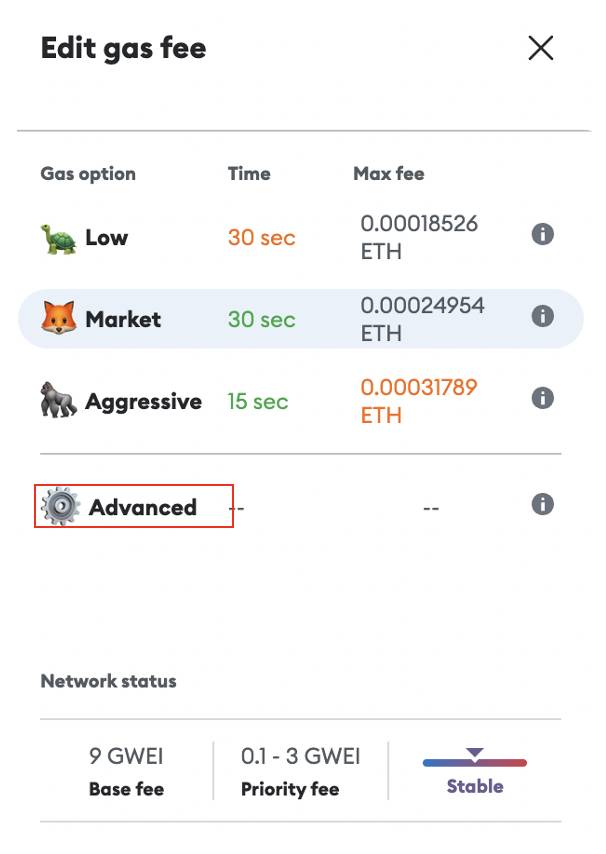

After that, you will have three different fee levels depending on whether you want your transaction to be processed slowly or quickly:

- “Low” pays a lower amount for gas and may require a longer waiting time.

- “Market” selects the fee based on the current market price.

- “Aggressive” executes the transaction quickly and pays a higher fee.

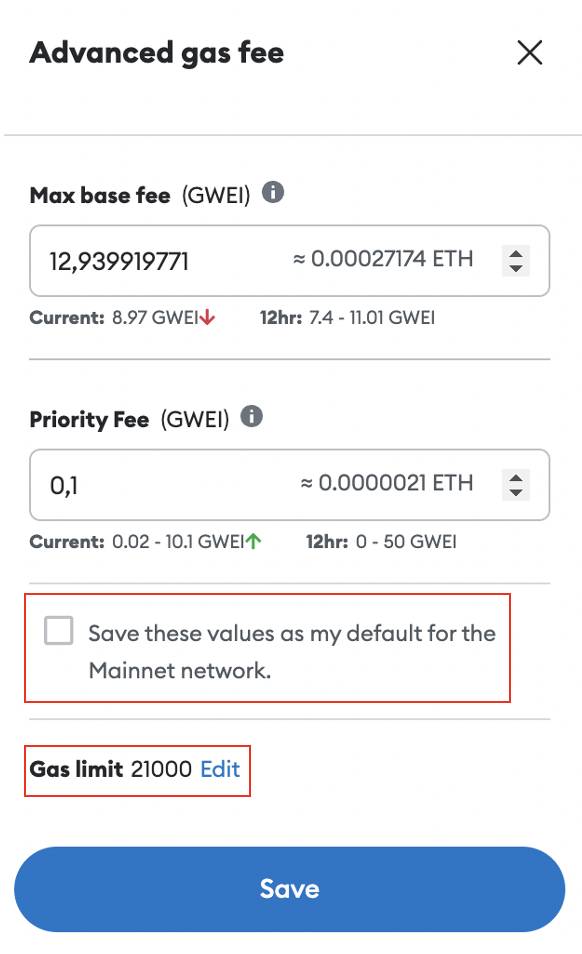

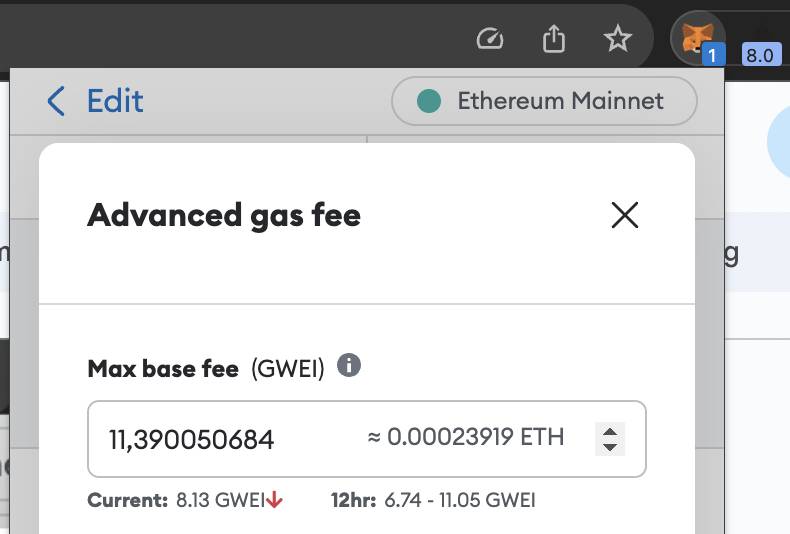

If the fee levels in the three options above still don’t meet your requirements, you can also choose “Advanced” to change the Gas limit. The Gas limit is the maximum amount of gas you are willing to pay for executing a transaction or EVM (Ethereum Virtual Machine) operation. The most suitable Gas limit is typically 21,000 gwei. If you set it lower than this threshold, the transaction is likely to fail.

If you want to reuse the settings you have adjusted, select the “Save these values… Mainnet network” checkbox. Then simply click “Save”.

- One important thing to note in order to avoid high gas fees is to limit transactions during peak hours when they are not essential.

1.2. Using the Ethereum Gas Price extension

The amount of gas you consume when performing a transaction is fixed and depends on the type of transaction. For example, a simple token transfer transaction has a Gas Limit of 21,000 gwei. However, the price per gas unit (Base fee) is not fixed and depends on supply and demand. If many people want their transactions confirmed, the gas price per unit will increase. Therefore, a transaction that should cost $1 in fees may cost $4 during high demand.

To make it easier for users, MetaMask automatically selects the gas price per unit for users. However, this price may not be optimized.

You can use Etherscan and go to the Gas Tracker section to check the prices, but it requires an additional tab to be opened. Instead, you can install the Ethereum Gas Price extension for your browser.

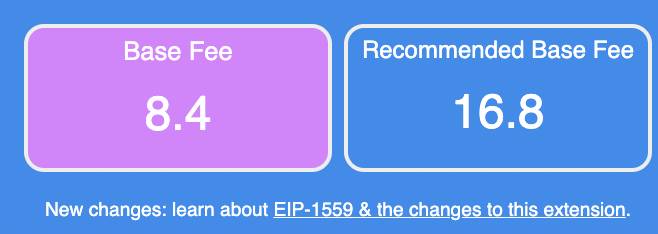

The extension tracks the average gas price paid in previous blocks for successful transactions and displays the recommended Base fee for the current transaction.

For example, in the screenshot below, the extension shows that the current Base fee is 8.4, but MetaMask is proposing 11.39 for your transaction. Based on this Base fee, you can manually adjust it down to 8.5. As a result, the transaction fee to be paid is lower than what MetaMask suggests.

Ethereum often experiences congestion, leading to expensive transactions. You can choose to use Layer 2 blockchains like Arbitrum, Optimism, and others to have lower gas fees and faster transaction completion times.

2. Canceling Transactions and Speeding up Transactions

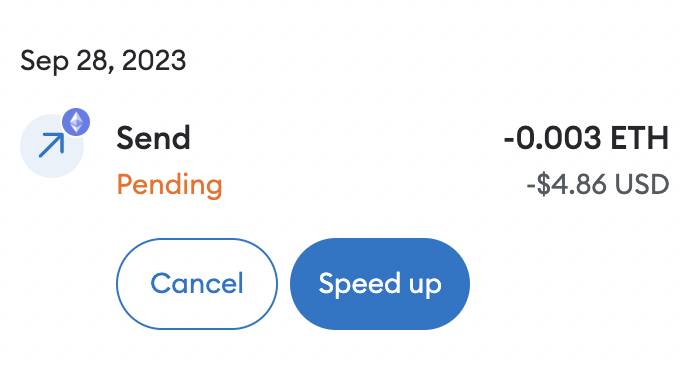

There are cases when an issue occurs, and a transaction gets stuck or remains pending for a long time, and you want to cancel it. There are several ways to handle this situation.

2.1. Canceling Transactions

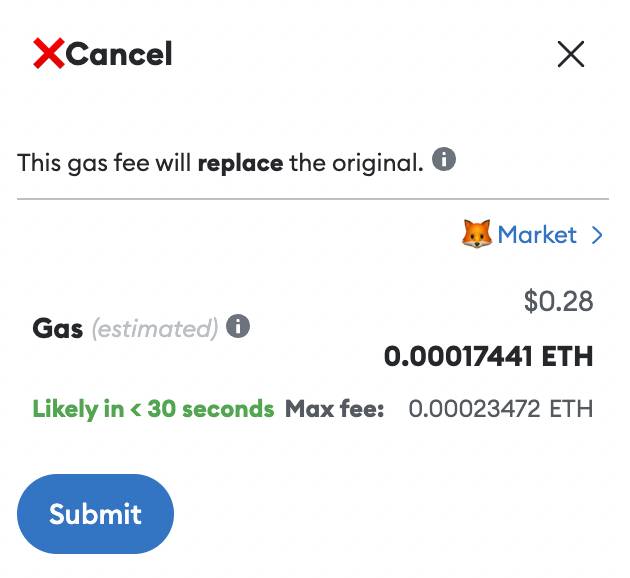

To cancel a transaction, simply click on “Cancel”. You can only cancel a transaction if it is still pending. Once a transaction is confirmed, it cannot be canceled.

2.2. Speeding up Transactions

You can speed up a transaction after you have accepted the proposed fee, and the network is ready to process your transaction. In some cases, when you need the transaction to be processed faster, you can choose to “Speed up” the transaction.

When you choose to speed up a transaction, it requires you to resend the same transaction with a higher gas fee, which can help accelerate the processing. When you speed up a transaction, you will see MetaMask display the new gas fee for the transaction to be processed faster.

At this step, some people might think that they have to pay an additional fee. However, because the process of speeding up the transaction uses the same nonce as the original transaction, you won’t need to pay gas fees twice.

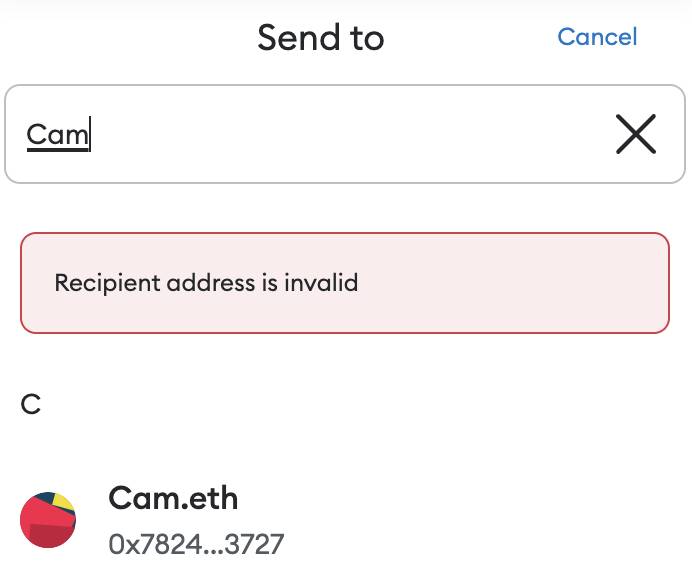

3. Creating Contacts for Regular Transactions

MetaMask has a feature called “Contacts” that allows you to save frequently used wallet addresses, saving you time when performing transactions. This is a convenient and user-friendly feature, especially if you frequently send tokens to specific wallets. This feature helps you avoid entering wallet information incorrectly and prevents issues related to wallet impersonation and hacking.

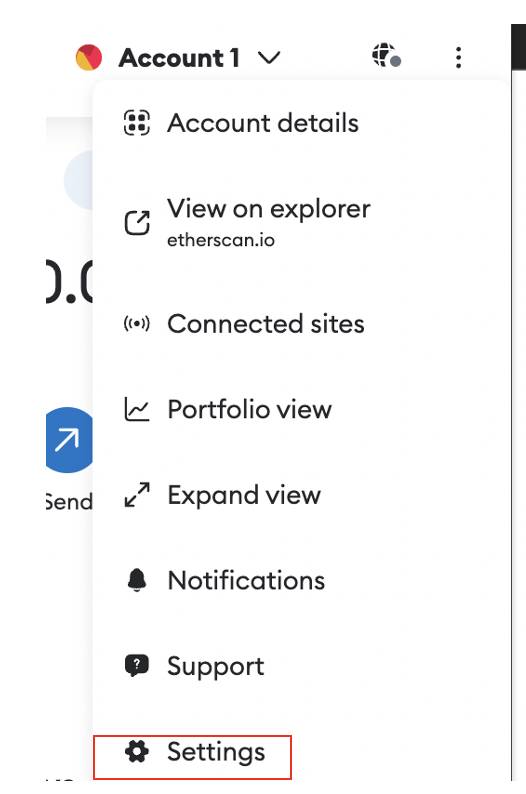

To access this feature, click on the three-dot icon on the top right of the MetaMask screen, and then select “Settings.”

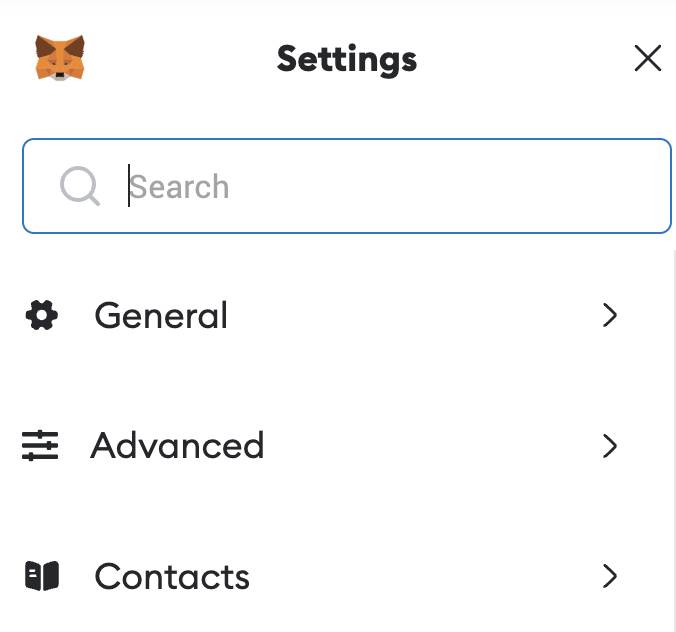

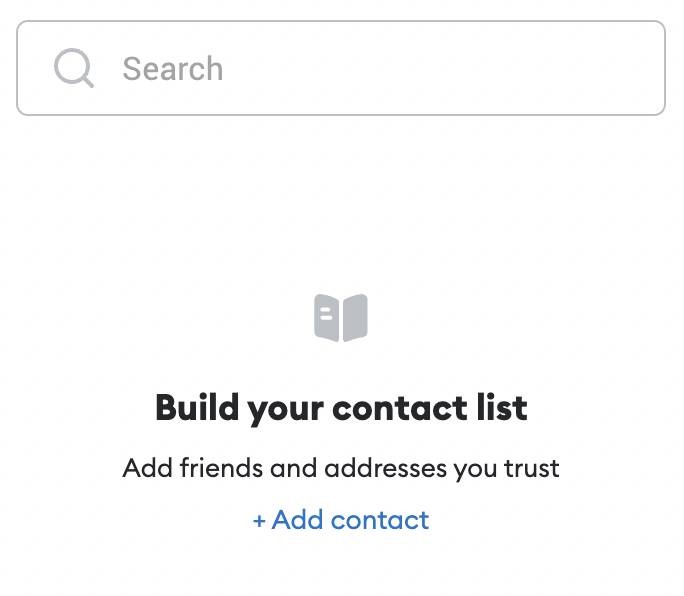

In Settings, select “Contacts.” This is where you will see the list of contacts you have added. To add a new contact, choose “Add contact.”

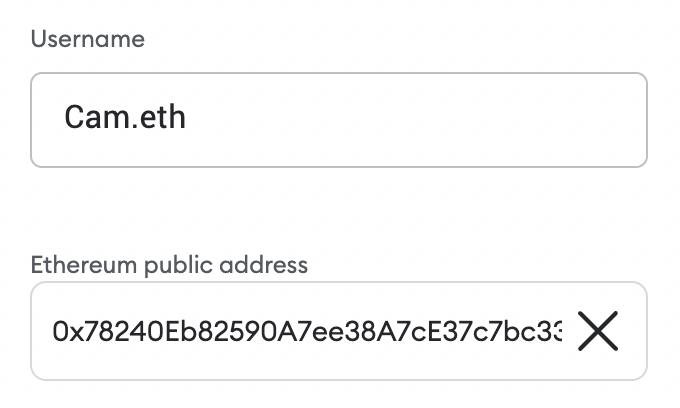

You need to provide two pieces of information: One is the Username, and the other is the Ethereum public address. After that, click on Save.

When you want to transact with this wallet in the future, you just need to enter the saved contact name.

4. Integrating with Etherscan

In the previous section, “Important Notes when using MetaMask,” I mentioned the risks of phishing and the potential damages it can cause to users if they are not careful. In this section, you can mitigate the risk of financial loss through some features provided by Etherscan.

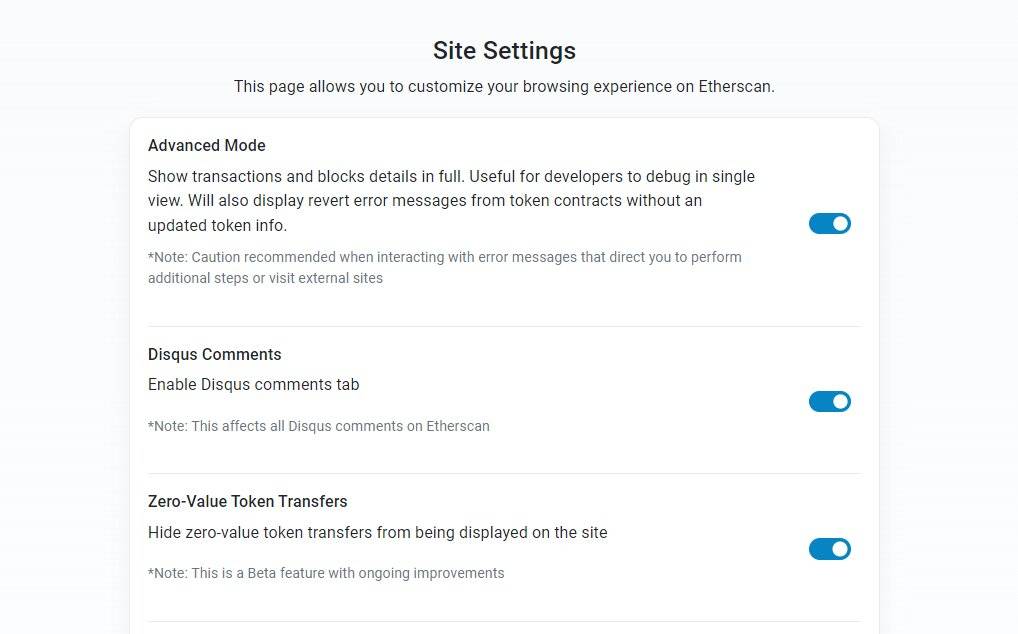

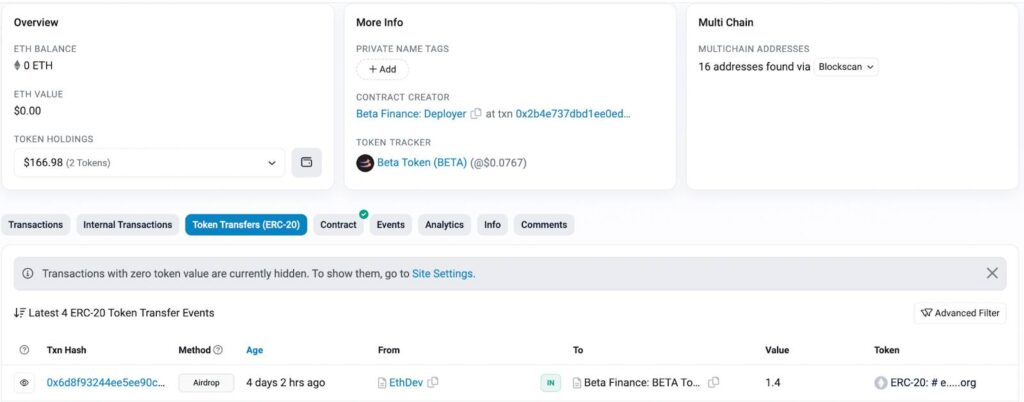

4.1. Filtering out zero-value tokens

Recently, there have been numerous cases of phishing attacks using impersonated addresses. These addresses frequently send tokens with zero value to the victim’s wallet address to avoid suspicion. When viewing your wallet transactions on Etherscan, you can utilize the Zero-Value Token Transfers feature to hide transactions involving tokens with a value of zero.

On the toolbar, select the ☀️/🌙 icon and then choose Site Settings. Typically, the Zero-Value Token Transfers mode is enabled by default for all users.

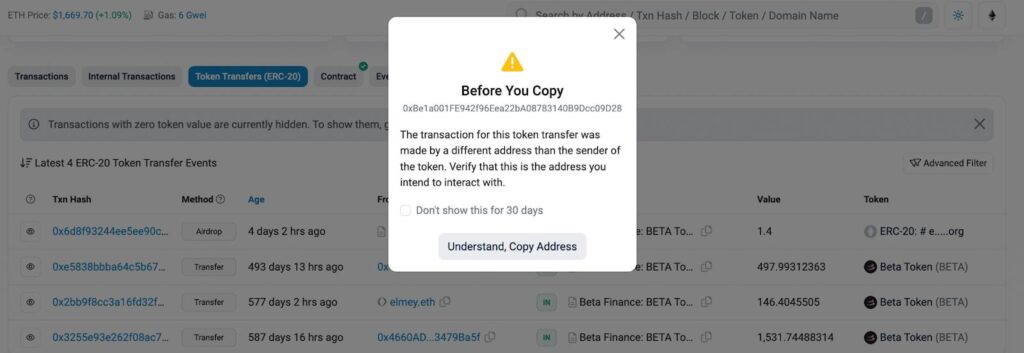

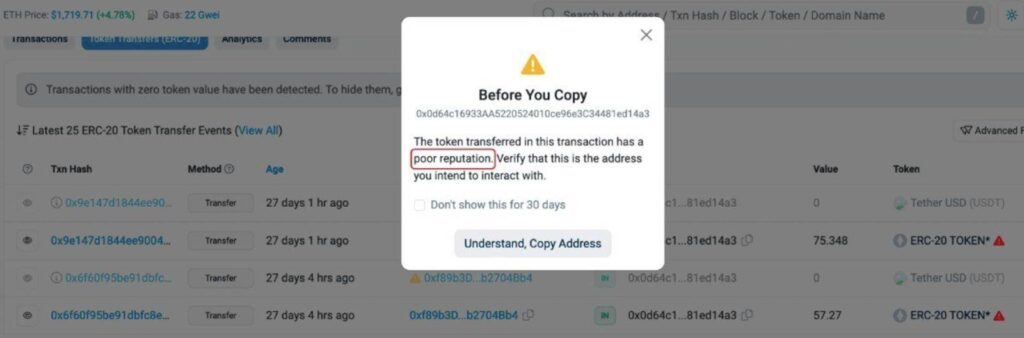

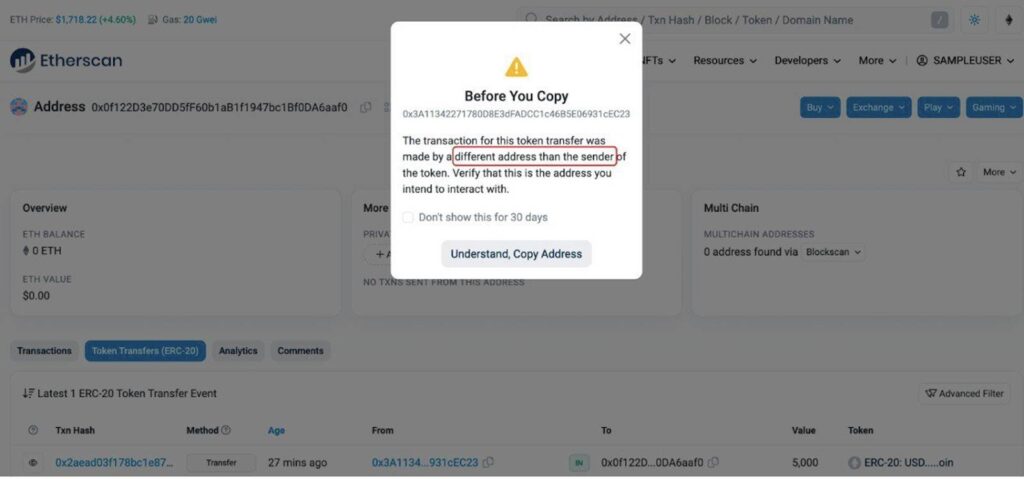

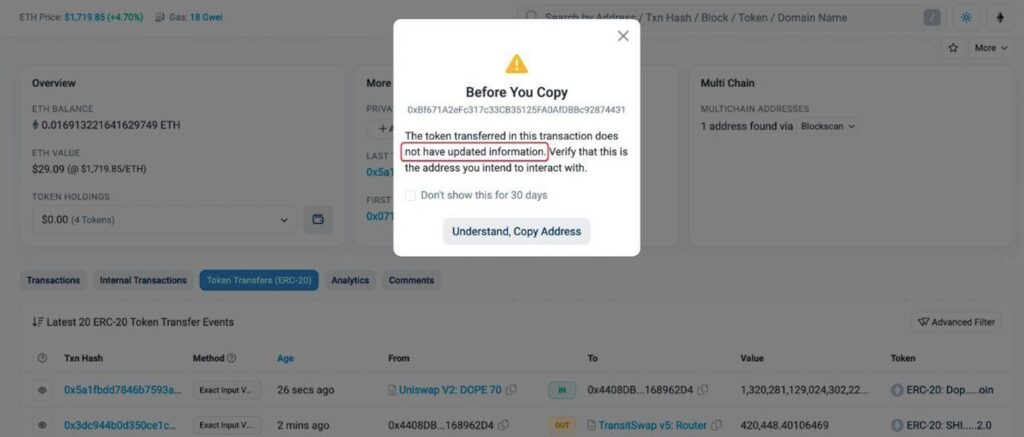

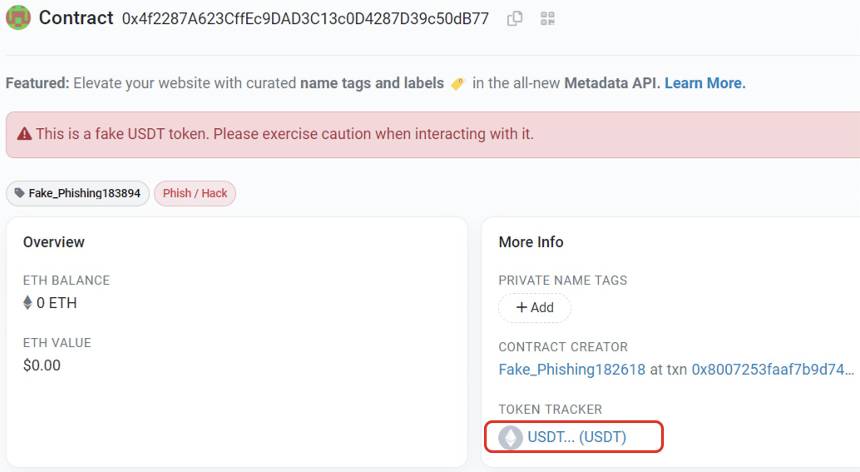

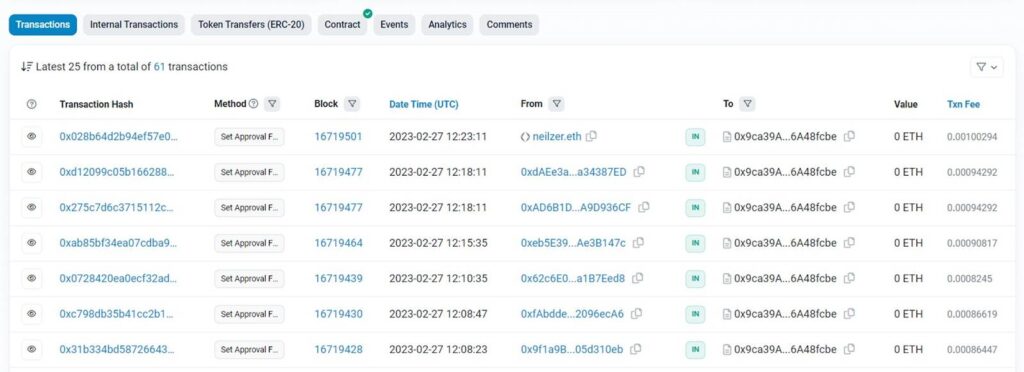

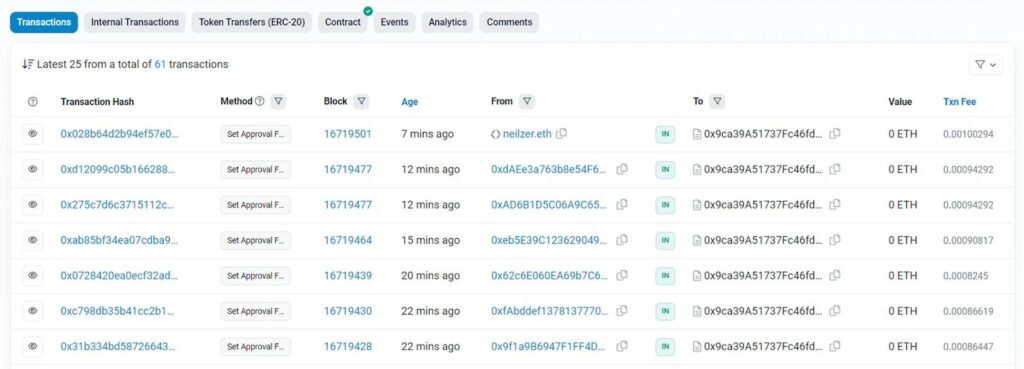

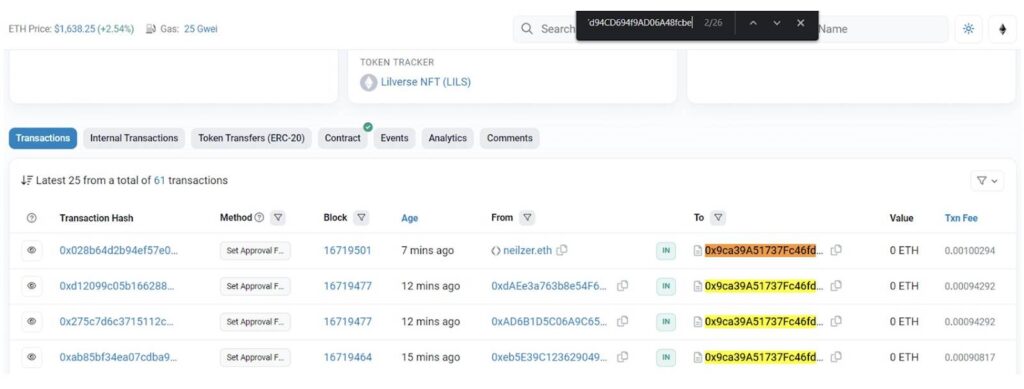

4.2. Pay attention to pop-ups from Etherscan

Another feature you can take advantage of is the warning pop-up when copying a suspicious wallet address or token on Etherscan.

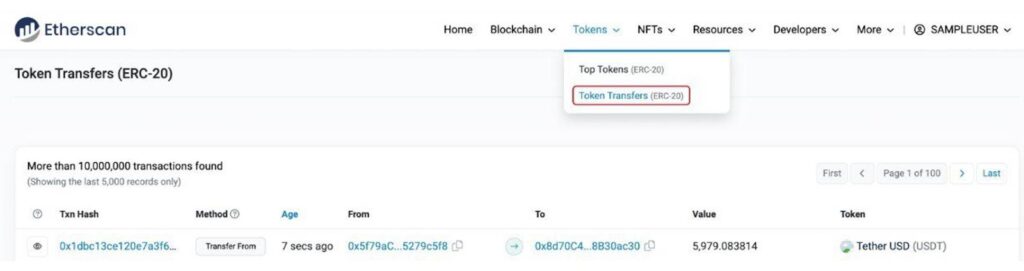

Correct, a pop-up window will appear when you copy the “From” or “To” address in specific situations while you are on the Token Transfer (ERC-20) tab on Etherscan. This helps alert you to the act of copying a suspicious address.

- Tab Token Transfer (ERC-20).

- Token Transfer (ERC-20) tab of a token.

With this feature, users are prompted to double-check if they are copying the correct address. The pop-up window appears when you copy the sender or recipient address in the following cases:

- Transactions involving tokens with a poor reputation.

- The transaction originates from a different address than the token sender.

- Token has no updated information.

In addition, you should pay attention to the red labels that Etherscan and the community have provided.

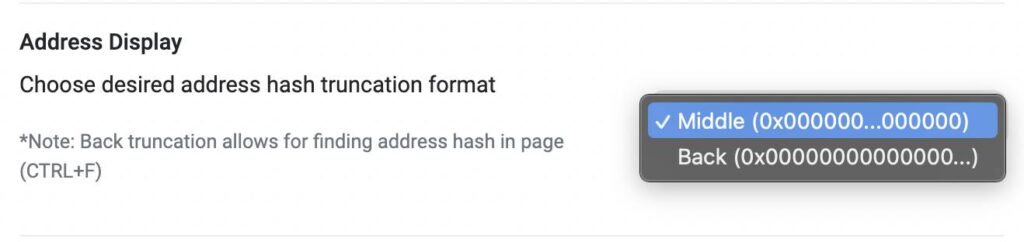

4.3. Adjusting the address format

When conducting transactions, ensure that you are copying the address correctly, whether it is from Etherscan, your personal wallet, or other applications. In some cases, wallets may have registered domain names, while others may not. Etherscan provides two display formats for wallet addresses: one displays a shortened version with the beginning and ending digits grouped together, while the other format shows a long sequence of digits at the beginning.

To help avoid errors, you can switch the wallet format to the second method. This approach will make it easier and faster for you to scan and verify addresses.

To change the wallet format, select the ☀️/🌙 icon in the top-right corner and choose “Site Settings.” Then, find the “Address Display” section and select your desired wallet display format.

Crypto

Explore in detail about Web 3

1. What is Web 3?

Web 3, also known as the Semantic Web, is the third generation of the internet technology platform aimed at addressing its limitations and optimizing utility with AI, blockchain technology, and moving towards the Metaverse to transform the internet into a reality similar to your everyday life.

A small example of Web 3: Suppose you are driving and need to find directions. In the past, you had to do it manually, or even with Google, you still had to visit a website and input your query. However, with Web 3, you only need to say something like, “I want to go to LonDon,” and the system will automatically provide the most optimal guidance without you needing to activate any applications or websites.

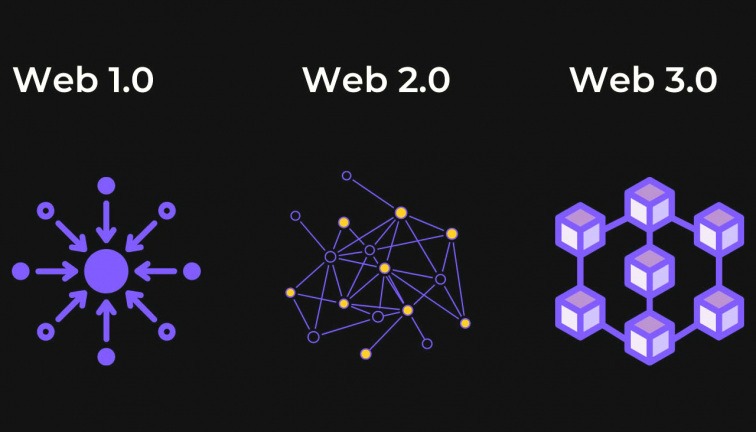

2. Understanding the Development Stages of the Web on Web 3

The web has undergone significant development in recent years. Looking at today’s applications, it’s hard to imagine that the web was initially in a very rudimentary and boring stage. The evolution of the internet is divided into three distinct stages: Web 1.0, Web 2.0, and Web 3.0.

Web 1.0: This is the first generation in the overall development process of the web. The term Web 1.0 typically refers to the earliest computer network connections in the 1970s and 1980s, up until the emergence of browsers and the first websites in the 1990s.

Web 2.0: It began to take shape in the mid-2000s. Key platforms such as Google, Amazon, Facebook, and Twitter dominated the internet market by enabling people to connect and transact online, with a few players dominating most of the market.

Web 3 (short for Web 3.0): It represents another application of blockchain technology beyond the most commonly seen cryptocurrency applications that we encounter daily. It is considered the future vision of the internet, where people primarily operate anonymously on decentralized platforms, rather than relying on tech giants like Google, Facebook, Twitter, and others.

3. How do Web 3 websites work?

By recording user activity logs on the blockchain, Web 3 enables users to share their data across the network environment and interact between websites using a single account. Web 3 improves privacy, enhances transparency, eliminates intermediaries, facilitates data ownership, and provides digital identity solutions. Web 3.0 functions like a database.

This massive database is accessible for searching information on the internet to answer your queries. It can know everything about you, acting as a counselor or assistant that accompanies you. Additionally, blockchain technology can enable more direct online transactions and interactions without the need for intermediaries and central servers as we have today.

4. Web 3 advantages:

Web 3 is decentralized

Built and developed on the Blockchain technology platform, Web3 applications have transactions that are directly exchanged peer-to-peer and are not controlled by any individual or organization.

In today’s Web 2.0, information data is stored on a specific platform controlled by developers, but in the world of Web3, information will be in multiple places and completely decentralized without going through any central authority.

Web 3 is highly reliable

Personal data is under your control and security. It seems there is no way for hackers to infiltrate the network and take your assets unless you disclose your password or wallet passphrase. Stealing users’ personal data is impossible for hackers unless they can hack the entire global internet network, which is not practical.

Web 3 can be self-managed

Anyone can participate in Web3. Information and data are managed and stored by you. No one can infiltrate, steal, or disclose your privacy unless you allow it. This is in complete contrast to platforms like Facebook and Google, where users have full control over their personal data on the platform’s servers.

Strong decentralization of Web 3

An application or platform on Web3 does not have a centralized server like a centralized web system. They exist continuously, side by side, day and night. Power outages due to natural disasters or server disruptions caused by hackers that affect current web server systems will not affect your experience in the Web3 world.

Data permanence of Web 3

Your information, games, articles, favorites, text messages, or other data on Web 3.0 will exist as long as the global internet is operational, and no one can access, modify, or delete it. It remains permanently over time and easily accessible at any time.

5. Web 3 disadvantages:

Enormous amount of spam data

Due to the decentralized and permissionless nature of Web3 networks, data can be uploaded in large quantities with less information. Both valuable messages and spam messages are stored on the network, leading to a poor user experience.

Additionally, inappropriate content for all age groups and unhealthy content (18+, violence, war, etc.) are serious issues that need to be addressed. Once data is on the blockchain, it remains there continuously, and no one can do anything about it.

Legal challenges

Imagine an internet platform where no one controls the content or sensitive topics such as politics, religion, war, etc. In a decentralized structure lacking control, cybercrime, inflammatory speech, and misinformation will become more severe. A free and decentralized web will also operate.

Enforcing legal regulations becomes more challenging across jurisdictions. Consider which country’s laws will apply to a website with content stored in multiple countries worldwide. This will drive a new mechanism in the new era, known as DAO (Decentralized Autonomous Organization).

Not user-friendly

Until now, Blockchain technology in general, and Web3 in particular, are still in the early stages of building trust and practical application in people’s lives.

The functions and usage can be quite complex and difficult to understand for certain demographics such as the elderly or those who are not tech-savvy. These features require users to have some knowledge of technology as well as the internet.

Unclear scalability

As information and data are continuously stored on the Web3 network, managing memory over time becomes a concerning issue that needs to be addressed. The transaction processing and data loading may slow down over time, negatively impacting the user experience.

Slow processing speed

The validating nodes must run based on the fundamental functions of the blockchain, which can lead to network congestion and a subpar user experience.

These are the most basic pieces of information regarding Web3 and its advantages and disadvantages. From a futuristic perspective, Web3 still needs improvement in many aspects, but it remains a promising solution for the current era.

-

AI1 year ago

AI1 year agoAI only needs to listen to the sound of keystrokes to predict the content, achieving an accuracy rate of up to 95%

-

AI2 years ago

AI2 years agoMusk aims to create a super AI to rival ChatGPT

-

Mobile2 years ago

Mobile2 years agoProduction issue with iPhone 15 display raises concerns among users

-

Entertainment2 years ago

Entertainment2 years agoSurprisingly, a single YouTube video has the potential to cause serious harm to Google Pixel’s top-of-the-line smartphone

-

AI2 years ago

AI2 years agoUpon its debut, Google’s chatbot Bard dealt a cold blow to its very creator.

-

Entertainment2 years ago

Entertainment2 years agoCS:GO Breaks Records with Surging Gamer Engagement and Increased Spending

-

Crypto1 year ago

Crypto1 year agoExplore in detail about Web 3

-

Entertainment1 year ago

Entertainment1 year agoRumors have been circulating about a live-action film about GTA, the creator of the series spoke out to confirm one thing.